Savvy Buyers Spur Food Safety Innovations in Meat Processing

Recent industry innovations improving the safety of the Nation’s meat supply range from new pathogen tests, high-tech equipment, and supply-chain management systems to new surveillance networks. Innovation, along with diffusion of innovation through imitation, helps lower the cost of safe food and increase consumer choice. With innovation, consumers can better choose the level of safety they desire.

Though food safety and food safety innovations are desirable, meat processors face special challenges that weaken their incentives to invest in food safety improvements. Some restaurant chains and large retailers are encouraging processors to overcome these challenges. These large, savvy meat and poultry buyers are setting and enforcing safety standards and creating markets for food safety. As a result, they are driving increases in food safety investments throughout the meat supply chain.

Incentives for Innovation Relatively Weak for Food Safety

In research conducted for well over half a century, economists have found that appropriability, the ability to control and exploit the benefits of an innovation, plays a key role in innovation. A firm will invest in food safety innovation only if it expects to reap benefits, such as an increase in sales, price premiums for safer foods, improved brand equity, consumer loyalty, lower recall costs, and reduced liability (see box, “How Is Innovation Defined?”).

Unfortunately, meat producers have had difficulties appropriating the benefits of food safety innovation because improved food safety is a difficult attribute to market to consumers. For the most part, food safety is a credence attribute, meaning that consumers cannot evaluate the existence or quality of the attribute before purchase, or even after they have consumed the product. Consumers cannot usually determine whether a food was produced with the best or worst safety procedures, or whether a food poses a health risk. For example, consumers cannot detect by sight, smell, or price whether a raw egg is contaminated with Salmonella.

Food companies have successfully marketed a long list of products involving credence attributes. For example, companies advertise their organic, dolphin-safe, and nongenetically engineered products and have developed a number of ways, such as third-party certification, to verify these credence claims. Surprisingly, in the food safety area, producers have been slow to adopt these verification mechanisms or to advertise their good safety records.

One reason may be that in advertising their good safety records, and thereby disclosing the poorer safety records of their competitors, firms also disclose general food facts that may alarm consumers. Firms may fear that consumers will not react positively to claims like “our Salmonella count is 50 percent less than the leading brand.” Meat producers may decide that though such advertising could differentiate them from poorer quality producers, any overt mention of safety risks could drive customers away.

In addition, firms may want to avoid specific safety guarantees that could expose them to greater liability. Food safety is not easy to guarantee, particularly in the case of pathogen contamination. While careful producers can greatly reduce their risks, even they can undergo a food safety problem. Deviations from planned procedures, uncertainty regarding input contamination, equipment malfunction, personnel factors, pathogen grow-back, and sampling variability all contribute to the potential for safety breaches. When a batch of Odwalla apple juice was made from apples that had fallen to the ground, contrary to company policy to use apples fresh off the tree, the deviation caused the 1996 E. coli O157:H7 outbreak.

Finally, some meat producers may not invest in producing safer food because they lack technical expertise, or know the probability of getting caught as the cause of a foodborne disease outbreak is low. For example, an individual consumer who becomes ill after eating contaminated ground beef cannot be certain that the hamburger caused the illness. The 1- to 5-day lag between ingestion and illness makes it difficult to know with certainty which of the multitude of foods eaten in this time period was responsible. This uncertainty reduces the risk of detection for firms with lax safety procedures.

Channel Captains Create Markets for Food Safety

What has happened in the last decade to spur food safety innovation? Foremost are the stringent requirements for pathogen control demanded by large meat and poultry buyers like Jack in the Box, Red Lobster, and many foreign buyers. These buyers have successfully created markets for food safety through their ability to enforce safety standards with testing and process audits, and to reward suppliers who meet safety standards and punish those who do not. These companies are referred to as “channel captains”—savvy buyers who monitor food safety up and down their supply chain. Through contracts with these channel captains, meat and poultry processors are better able to appropriate the benefits of their investments in new food safety technologies.

Two case studies and a national survey of meat and poultry plants illuminate the role of these savvy buyers in creating a market for food safety and driving innovation.

Innovative Pathogen Detection Program Meets Buyers’ Requirements

After the deaths of several children in the 1993 outbreak of E. coli O157:H7 caused by contaminated ground beef, Jack in the Box canceled all its contracts with hamburger patty suppliers, required new food safety assurances, and asked the meat companies to work with them to ensure the safety of their hamburger patties. Texas American Foodservice Corporation was one of two companies to answer this challenge. Texas American, a large supplier of hamburger patties to fast food chains, developed a system for sampling and testing ground beef and hamburger patties for microbial pathogens. Texas American collaborated with the pharmaceutical firm DuPont, which had developed a superior system for detecting E. coli O157:H7 as the cause of human illness. The DuPont detection system uses Polymerase Chain Reaction (PCR) technology, which is faster and more reliable than traditional microbiological testing methods. Texas American and DuPont worked together to apply the PCR testing technology to ground beef.

Texas American also developed a sampling protocol for the new system. Sampling protocols are critical to the management of pathogen risk because while testing every product is not economically feasible, enough product must be tested to manage risk to an acceptably low level. Texas American tests samples at three locations in the plant: incoming beef trim, ground beef at the final grind head, and hamburger patties. Samples are taken at 15-minute intervals and suppliers are notified if any pathogens are detected. In addition, the temperature of incoming beef trim must be 40 degrees Fahrenheit or less, and all beef trim must be ground within 5 days after the carcass is broken into steaks, roasts, and trim. Random tests verify the efficacy of Texas American’s sanitation procedures.

The emergence of technically proficient buyers and the development of a market for safer hamburger patties have allowed Texas American to benefit from its food safety investments. Texas American evolved from being a commodity producer dependent on the spot market to a contract supplier. A contract supplier knows how much product is to be delivered by set dates and can plan its inventory and production schedule accordingly. This shift has allowed Texas American to improve its operational efficiency through better planning for capacity utilization, capital investment, spending plans, and other business activities. Texas American has also been able to use its expertise in pathogen control to attract new customers. Texas American estimates that 25-30 percent of its new sales between 1998 and 2001 occurred because of its superior safety record.

Equipment Innovation Requires a Buyer and Collaboration

The development and commercialization of Frigoscandia’s beef steam pasteurization system illustrates the ripple effect that the emergence of food safety markets can have on the entire supply chain—all the way down to equipment manufacturers.

In 1993, Frigoscandia Equipment, a Swedish refrigeration company, designed a system to reduce the level of microorganisms, particularly pathogens, on the surface of meat carcasses using steam. The use of steam to kill pathogens was not new, but its application to sides of beef was. A stainless steel cabinet is installed at the end of the slaughter line, just before the sides of beef (hanging from an overhead rail) enter the chiller. Within the cabinet, a blanket of steam kills pathogens on the surface of the beef. The clean beef then enters the chiller. From the chiller, the beef will be cut up into steaks, roasts, and trimmings for hamburger.

To reduce marketing risk and better tailor the invention to the needs of the beef industry, Frigoscandia Equipment partnered with Excel, the second largest U.S. beef packing company. With Excel’s expertise in operating beef packing plants, the innovation could be tested in high-speed, large plants to create a commercially viable new technology. Frigoscandia and Excel then asked Kansas State University microbiologists to independently test the pathogen-reducing performance of the equipment. The Kansas State team found that steam pasteurization was the most effective control method of those studied in reducing pathogenic bacteria on surfaces of freshly slaughtered beef.

After receiving acceptance of the technology from USDA’s Food Safety and Inspection Service (FSIS) in 1995, Frigoscandia Equipment began marketing its equipment. To keep competitors from selling “knockoffs,” Frigoscandia secured four patents. Frigoscandia benefited from its innovation with strong sales.

By 1997, Excel had installed the equipment in all its beef slaughter plants, and IBP, the largest beef packer in the U.S. announced its intent to install the equipment in its plants. Excel benefited from its early collaboration with Frigoscandia by positioning itself as a leader in food safety and enjoying an increase in beef sales and contracts.

A National Survey Confirms the Importance of Buyer Specifications

Both case studies indicate the importance of channel captains in creating markets for food safety and spurring innovation. But how widespread is this phenomenon in the U.S. meat and poultry industry?

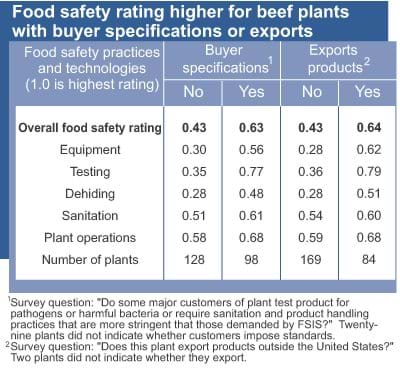

A national survey of U.S. meat and poultry slaughter/processing plants was conducted by researchers from ERS and Washington State University (see “Market Incentives Raise Food Safety Bar” in this issue). The survey contained 40 questions about food safety technologies and practices in five broad categories: equipment, testing, dehiding (for cattle slaughter plants), sanitation, and plant operations (see box, “Plant Managers Queried About Safety Procedures”).

An index from zero to one was created to rate the use of food safety technologies and practices across meat and poultry plants. Plants earned higher ratings if they reported sophisticated food safety equipment, conducted more extensive pathogen testing, or employed more intensive cleaning operations. The data reveal wide variability in food safety practices among U.S. plants.

Food safety index scores are considerably higher in all five safety categories for beef companies that face buyer specifications for pathogen control than for those that do not. For example, plants that said their products must meet stringent buyer requirements, including foreign buyers, had scores of 0.77 for testing, while those that did not had scores of 0.35. The results support what was learned in the two case studies. Buyers who pay a premium or guarantee sales for higher safety standards enable suppliers to benefit from investments in food safety technologies.

In all five categories, the food safety index score is markedly higher for beef companies that export than for those that do not, suggesting that foreign buyers are imposing food safety requirements and acting very much like large domestic buyers. Differences in the index scores are larger for equipment, testing, and dehiding technologies than for sanitation and plant operations.

Channel Captains Benefit, Too

The emergence of large, technically proficient buyers is helping to create markets for food safety and spur food safety innovations. The question remains as to why some fast food restaurants and large retailers have adopted the role of channel captains, monitoring the safety of products up and down the hamburger supply chain. Why have they taken on the added expense of testing and audits?

The major, name-brand fast food restaurant chains and large retailers are able to appropriate some of the benefits of their investments in food safety because of enhanced reputations for safe food. Maybe even more importantly, though, these firms benefit from their investments through a reduced risk of being associated with a foodborne illness outbreak. This is doubly important for restaurants that tend to have higher risk of liability than others in the meat supply chain because they are more easily identified than others in the chain and because they are responsible for final food preparation. In addition, restaurant and retail chains have much to lose if identified as the source of an outbreak, namely their large investments in brand name equity.

Could Government Provide Additional Incentives?

The success of the fast food restaurants and other channel captains in stimulating innovation reveals the importance of information for safety performance. All channel captains require their suppliers to provide testing and/or other evidence that food safety standards have been met.

Government policy targeted at increasing information on safe and unsafe producers may help spur innovation. The Federal Government, for example, could post more food safety information about the performance of individual plants and their products, enabling consumers and commercial buyers to compare safety records. Government-approved “Enhanced Food Safety” labels would be an additional cue to consumers. This information increases the visibility of food safety innovators, allowing them to appropriate the benefits of their investments.

<a name='box1'></a>How Is Innovation Defined?

Innovation is all the activities that result in new products or new production methods. It is all the scientific, technological, organizational, financial, and commercial activities necessary to create, implement, and market new or improved products or processes. Innovation takes two forms: product innovation and process innovation.

A product innovation is the development and commercialization of a product with improved performance characteristics. Product innovation tends to expand consumer choice. More product choice allows more consumers to find products that better match their particular set of tastes and preferences, thereby expanding consumer welfare. For example, pre-washed lettuce, baby carrots, and green ketchup have expanded consumer choice and well-being.

This welfare-increasing effect of product innovation is not guaranteed, however. Product innovations that become the industry or regulatory standard may ultimately reduce, not increase, product differentiation and consumer welfare. For example, some cities prohibit sales of unpasteurized milk to protect consumers from pathogens in unpasteurized milk. However, this regulation eliminated consumers’ choice to buy raw milk.

A process innovation is the development or adoption of a new or significantly improved production or delivery method. Process innovations may be technological or organizational, involving changes in equipment, human resources, working methods, or any combination of these. Process innovation tends to make production more efficient. Some or all of these efficiency gains may be passed on to consumers in the form of lower prices.

The distinction between product and process innovation for food safety is not clear cut. Food safety process innovations often lead to product innovations—safer foods—not just the same level of safety at less cost. Ultra-high-temperature heating (UHT) and irradiation are two process innovations that have created product innovations: safe, shelf-stable juices and milks in convenient boxes in the case of UHT, and safer spices and meat patties in the case of irradiation. Even such processing changes as properly refrigerated trucks, lot coding, lay-date stamping on eggs, pathogen testing, and instant-read thermometers all lead to safer final products, blurring the line between process and product innovation.

<a name='box2'></a>Plant Managers Queried About Safety Procedures

Almost 1,000 plant managers or food safety officers responded to the ERS/Washington State University survey. Forty questions covered food safety protocols, investments, and recent changes in response to market conditions or to the 1996 Pathogen Reduction/HACCP regulations. Sample questions from each of the five categories follow:

- Equipment. Does the plant use a steam carcass pasteurizer, such as Frigoscandia’s?

- Testing. Does the plant conduct more tests than required by Federalregulation and, in particular, does it test raw or cooked product for E. coli O157 or Listeria?

- Dehiding. Does the plant use an air exhaust system vacuum or other system that creates negative air pressure around the carcass in the dehiding area?

- Sanitation. How often are drains sanitized?

- Plant operations. Are employees offered incentives, such as gifts or compensation, for detecting and reporting possible sources of contamination or unsanitary conditions?

Food Safety Innovation in the United States: Evidence from the Meat Industry, by Elise Golan, Tanya Roberts, Elisabete Salay, Julie Caswell, Michael Ollinger, and Danna Moore, USDA, Economic Research Service, April 2004

Food Safety, by Sandra Hoffmann and Michael Ollinger, USDA, Economic Research Service, February 2024