Meat-Processing Firms Attract Hispanic Workers to Rural America

Highlights:

-

The meat-processing industry is switching to lower skilled labor and increasingly relocating plants to rural areas.

-

Hispanics are moving into the meat-processing labor force and helping to meet demand for low-skill workers.

-

Hispanic inmigration mitigates rural population decline and stimulates local economies.

Over the past 40 years, the U.S. meat-processing industry has been transformed by changing consumer preferences for meat products, which helped trigger a consolidation within the industry and a geographic shift in the location of meat-processing plants to rural areas. Technological innovations have also enabled processing plants to make substantial gains in efficiency. Despite these and other changes, employment across the industry has risen during the period, bucking trends in the manufacturing sector. Increasingly, the demand for workers in rural meat-processing plants has been met by the Nation’s growing Hispanic population.

Between 1980 and 2000, the Hispanic share of meat-processing workers increased from under 10 percent to almost 30 percent, while the Hispanic workforce itself became mostly foreign born. While the rapid population growth and geographic dispersion of Hispanics since the 1990s has helped meet the labor needs of rural-based meat-processing plants, Hispanic settlement has also had social and economic implications for rural communities.

Americans Change Their Eating Habits

Consumption trends have influenced labor demand in the meat-processing industry. Throughout the 1950s, Americans consumed about three times as much beef and twice as much pork, per capita, as poultry. Since then, technological innovations in poultry production, such as the integration of chicken breeding and slaughtering operations and increased use of specialized processing technology, have increased plant efficiency and enabled firms to reduce poultry prices. From 1960 to 1997, the retail price of whole chickens steadily declined in real dollars from $1.38 to $0.62, which bolstered demand. In contrast, the real price of beef increased from $2.70 in 1960 to $4.86 in 1982 before falling to $1.74 by 1997.

Poultry consumption received an additional boost from fast food marketing, growing consumer awareness of health considerations, and the popularity of low-fat diets. Consequently, between 1970 and 2000, per capita annual consumption of beef declined (from 80 to 65 pounds), while that of chicken almost doubled (from 28 to 53 pounds). After the mid-1980s, the beef sector implemented production strategies and technologies similar to those of the poultry sector and beef prices fell significantly. But changes in consumption behavior and relative prices of meat products over the previous two decades had helped to permanently alter Americans’ eating habits. Thus, by the end of the 1990s, Americans were consuming less beef, the same quantity of pork, and twice as much chicken and turkey as in 1970.

Another trend affecting the meat-processing industry was the growing domestic demand for pre-cut and further-processed products. As more women entered the labor force in the 1960s, American consumers increasingly demanded convenient-to-prepare food. Beef, pork, and poultry firms responded by supplementing their slaughtering plants with production facilities that further processed meat. Cut-up meat products increased from a relatively minor share of all meat production in the early 1960s to the dominant output by the 1990s. In 1963, for example, the poultry product mix sold in American supermarkets consisted of 85 percent whole birds and 15 percent cut-up products; by 1997, that proportion had reversed completely. In addition to cutting up meat products for different markets, many large pork and poultry plants also season, cook, sort, and/or package meat prior to shipment.

Changing consumer preferences and the meat industry’s increased emphasis on pre-cut and pre-packaged meat have also helped to expand meat exports. The predominance of packaged meat products facilitated the export of beef and pork products. Changing preferences among U.S. consumers led to a segmentation of products targeted to domestic and international poultry markets. For example, chicken breasts and other white meat are mainly shipped to domestic markets, and chicken legs and other dark meat are exported, primarily to China, Mexico, and Russia. U.S. poultry exports, which for decades rarely exceeded 5 percent of all poultry production, increased from roughly 135 million pounds in 1970 to 5.6 billion pounds by 1997, about 17 percent of production.

All of these trends affected employment levels in the meat-processing industry, particularly the poultry industry, where growth in consumption was the highest. Between 1972 and 2001, employment in the poultry processing industry jumped from 106,600 to 258,200, or roughly 150 percent. In the beef and pork processing industry, employment increased modestly from 240,400 to 253,100 over the same period. Despite extensive mechanization, growth in both carcass size and the sheer variety of new and further-processed products, such as boneless cuts and marinated and precooked meat products, required additional cut-up and production operations and workers, which generated considerable demand for low-skilled manual labor in meat-processing facilities.

Fewer Firms, Larger Plants

In response to growing competition within the industry, new technological opportunities, and changing consumption patterns, meat processors gradually shifted production to larger, more specialized plants, increasing profitability through economies of scale. In the 1950s, for example, poultry-processing operations began to contract with poultry growers for specific sizes of birds at set prices while providing growers with chicks, feed, vitamins, and other necessary inputs. Although production processes differed from the poultry-processing industry, other meat-processing sectors subsequently initiated similar practices with comparable outcomes. These changes reduced producer costs, which benefited consumers. Between 1960 and 1997, consumer prices declined roughly 55 percent for poultry and 35 percent for beef.

As smaller producers struggled unsuccessfully within this increasingly competitive sector, plant consolidations gradually led to an industry dominated by fewer firms and large processing plants. By the end of the 1990s, plants with more than 400 employees accounted for most U.S. meat production. Since the 1970s, the “four-firm concentration ratio”—the proportion of total production controlled by the four biggest companies—has increased markedly. By the late 1990s, four firms accounted for roughly 50 percent of all U.S. poultry and pork production and 80 percent of all beef production. Both trends—increasing plant sizes and industry consolidation—contributed to the growing demand for low-skilled workers.

More Meat-Processing Plants Are Located in Rural Areas

In addition to industry restructuring, meat-processing firms have increasingly relocated plants to rural areas to reduce livestock transportation and feed costs, ensure more consistent quantities of animals, and thereby use processing plants around the clock and throughout the year because of fewer interruptions in livestock supply. Economic incentives offered by rural communities, along with the greater likelihood that rural-based plants are not unionized, have also induced firms to relocate plants.

Rural relocation varies by sector. Chicken production has for many years been concentrated in the rural Southeast; in 1993, the four leading poultry-producing States were Arkansas, Georgia, Alabama, and North Carolina, all with large proportions of rural residents. In contrast, beef-processing plants have tended to relocate from urban areas to places near large feedlots where cattle are raised, notably in Colorado, Nebraska, Kansas, Oklahoma, and Texas. Hog-processing plants have relocated to nontraditional regions outside the Midwest to take advantage of lower land and labor costs in rural areas of the West, Southwest, and Southeast.

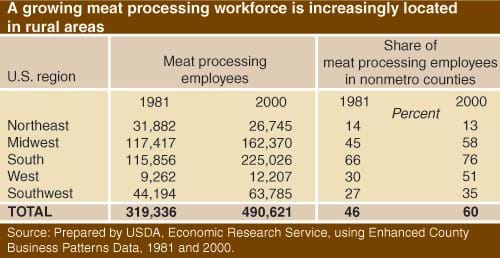

In all regions of the Nation except the Northeast, jobs in meat processing have shifted from metro to nonmetro counties, reflecting an urban-to-rural transition that began in the 1980s. The shift is remarkable in light of the sizable increase in the number of persons employed in the industry. In the South, for example, meat- processing employment doubled between 1981 and 2000 while the nonmetro share increased from 66 to 76 percent. Over the same period, the total number of U.S. meat-processing employees in rural areas doubled from 147,000 (46 percent of U.S. total) to 294,000 (60 percent of U.S. total). Labor demand in meat-processing plants increasingly could not be met in nonmetro counties in the Midwest and Great Plains, regions that have lost population consistently over the past 50 years. In contrast, jobs were filled more easily in the nonmetro South and West, where population has increased during the past 50 years due to growth in the manufacturing, service, retirement, and recreation sectors.

Hispanic Workers Constitute a Growing Share of the Meat-Processing Labor Force

All of these conditions—changing consumer preferences for more convenient foods, industry consolidation and concentration, and relocation to rural areas—contributed to either a growing demand for, or a shortage of, low-skilled workers in the meat-processing industry during a period when overall manufacturing employment declined in the U.S. In addition, stable or declining real wages from meat-processing employment made it relatively less appealing than alternative occupations and careers for an increasingly well-educated native-born workforce.

Historically, meat-processing employment offered relatively stable and well-paid employment for those with below-average education levels. Faced with mounting competition in the late 1970s, however, beef- and pork-processing firms with unionized plants in the Midwest demanded that workers accept wages comparable to those of nonunion plants. Poultry processing firms based in the Southeast had no tradition of unionized plants, and real wages in the industry have remained unchanged for roughly three decades. At the same time, meat-processing plant work has become increasingly deskilled as a result of greater technological innovation. Thus, what had been an urban-based, unionized, and often skilled workforce employed in production plants, supermarkets, and butcher shops in the 1950s gradually changed into a rural-based, mostly nonunionized, and low-skilled workforce concentrated within manufacturing plants by the end of the 1980s, as it remains today.

Meat-processing wages continue to exceed those of low-skilled employment in other manufacturing sectors, but meat-processing work is relatively hazardous. Employees in rural plants may face greater challenges than urban-based workers, such as a lack of conveniently located housing, limited public and retail services, and longer, more costly commutes. Not surprisingly, large rural-based processing plants have difficulty filling employment slots, and turnover rates approaching 100 percent annually are not uncommon in some plants.

Although meat-processing is situated within the broader U.S. manufacturing sector that has seen employment levels decline, changes in meat-processing itself—the organization of production, industrial concentration, and plant relocation—have increased demand for low-skilled workers. Foreign-born Hispanics have helped meet that demand. Between 1980 and 2000, the share of non-Hispanic Whites in the meat-processing workforce declined from 74 to 49 percent. In contrast, the share of Hispanics increased from 9 to 29 percent, with the foreign-born segment of the Hispanic meat-processing workforce increasing from 50 to 82 percent. Roughly 1 in 10 nonmetro Hispanics now works in meat processing.

Hispanic Population Growth Transforms Rural Communities

The transformation of the meat- processing industry over the past four decades has significantly increased its labor demand and generated a workforce with a growing Hispanic presence. In the Southeast, for instance, a spike in the rural Hispanic population during the 1990s is clearly linked to a growing Hispanic representation in the poultry- processing industry. Hispanic and foreign-born workers in meat processing follow a pattern found in crop agriculture, forestry, construction, low-skilled services, and many other nondurable and durable goods manufacturing sectors. As educational attainment for the general population rises, and industrial restructuring and greater employment options reduce the relative attraction of low-skilled jobs, U.S. firms can be expected to employ growing shares of Hispanic and foreign-born workers.

Recent Hispanic population growth in nonmetro counties outside the Southwest represents one of the more profound social transformations currently affecting rural areas, altering their social and economic profiles as well as the broader national perception of rural and small-town America. Although a small share (10 percent) of all U.S. Hispanics live in nonmetro counties, the rapid growth of the U.S. Hispanic population—exceeding 100 percent in about half of all States over the past decade—has significant implications for rural communities. Hispanic population growth can alter demographic trends, as it has throughout the Central Great Plains, which since the 1950s has steadily lost population due to increased agricultural labor productivity and outmigration of young adults. During the 1990s, Hispanic population growth actually stemmed overall population decline in over 100 nonmetro counties.

Moreover, new Hispanic residents stimulate local rural economies as consumers, in addition to contributing considerably to local sales, property, and State tax revenues. Rural Hispanic population growth also has significant policy implications for social service provision. Because Hispanics in new nonmetro destinations are often younger and more economically disadvantaged than native-born residents, they may place new demands on resources allocated to local health care delivery, public schools, and various forms of public assistance. Rural communities seeking to attract companies to locate plants in their districts will be in a better position to integrate foreign-born newcomers and augment their public services accordingly if they are aware of these ramifications.

New Patterns of Hispanic Settlement in Rural America, by William Kandel and John Cromartie, USDA, Economic Research Service, May 2004

Restructuring of the US Meat-Processing Industry and New Hispanic Migrant Destinations, Population and Development Review, January 2005, 31(3): 447-471.

Consolidation in U.S. Meatpacking, by James M. MacDonald, Michael Ollinger, Kenneth Nelson, and Charles Handy, USDA, Economic Research Service, March 1999

Structural Change in U.S. Chicken and Turkey Slaughter, by Michael Ollinger, James M. MacDonald, and Milton Madison, USDA, Economic Research Service, November 2000

Impacts of Hispanic Population Growth on Rural Wages, U.S. Department of Agriculture, Economic Research Service, September 2003, AER-826